New 5 Year Treasury Bond Future - 1 month to launch

Launching trade date 30 November 2020, the new 5 Year Treasury Bond Future will provide an additional liquidity point and hedging tool at the mid part of the curve, allowing for more efficient and effective risk management.

Key Features

- The contract will be cash settled against the average price of a basket of Treasury Bonds. For details on the March 21 and June 21 Bond Baskets, click here

- Spread functionality will be available for calendar and inter commodity spreads (against the 3 and 10 Year Bond Futures)

- Prices will be quoted in multiples of 0.5 basis points (0.25 basis points during the period of the roll)

- Face value of 100,000 and 2% coupon

- Market makers will support pricing in the contract from day 1

Testing

The 5 Year Bond Future is available in the Customer Development Environment for testing under the code VT. Information on contract specifications and vendor codes can be found in the 5 Year Bond Future factsheet.

Interest rate derivatives: OTC and Futures

Rates futures volumes for the period Q3 2020 reached 31.8 million contracts, an increase of 19% on the prior quarter. Activity at the front end of the yield curve continues to be impacted by the low rate environment and RBA Yield Curve Control with turnover in the 30 Day Interbank Cash Futures and 90 Day Bank Bill Futures down on the prior quarter (51% and 8% respectively). Turnover in 3 Year Bond Futures was up 18% when compared to Q2 2020 while Open Interest also finished the quarter higher at 1.18 million contracts vs 998k contracts as at 30 June 2020. Activity in the 10 Year Bond Futures was the standout, increasing by 28% when compared to Q2 2020 while Open Interest reached 1.53 million contracts, an increase of 24% on the prior quarter (1.23 million as at 30 June 2020).

For the month of September, 3 year Bond Futures EFP volumes reached 1.4m vs 983k monthly average while 10 year Bond Futures EFP volumes were 729k vs 609k monthly average. Elevated EFP volumes were primarily driven by increased issuance from the AOFM, with a new $25 billion September 2026 line driving the uplift in 3 year EFP activity. The AOFM have signaled that they do not intend to establish further lines for the remainder of the calendar year.

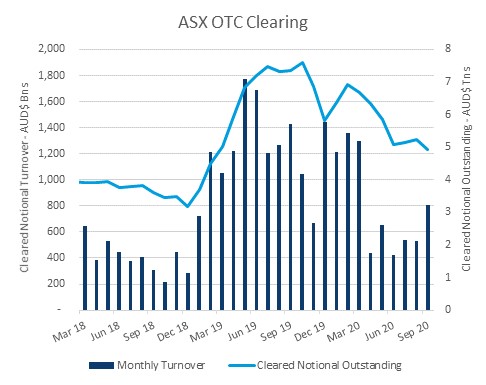

Global AUD OTC swap volumes continue to be lower driven by a significant decrease in shorter-date interest rate swap and OIS volumes as a result of the low rate environment and yield curve control. ASX’s OTC Clearing service has continued to perform well in this environment, with total notional cleared of A$1.825 trillion in Q3 2020, up 20% vs Q2 2020. Cleared notional outstanding at quarter end declined slightly down 3.5% vs end Q2 2020.

NZD OTC Clearing activity increased substantially during the quarter with NZ$50bn notional value cleared during Q3 2020 across NZ Interest Rate Swaps and NZ Overnight Index Swaps. ASX continues to be a highly capital and cost efficient venue for AUD and NZD interest rate derivatives via its ability to offer both cross-product (futures vs OTC swaps) and cross-currency (AUD vs NZD) margin offsets across its Rates product suite.