We are pleased to provide the ASX Rates Highlights Q4 report for the period October to December 2022 and the full chart pack.

ASX Rates Highlights Q4 – October to December 2022

Fixed Income Futures, OTC and Benchmark insights - Q4 2022

ASX Rates Highlights Q4 – October to December 2022

Fixed Income Futures, OTC and Benchmark insights - Q4 2022

We are pleased to provide the ASX Rates Highlights Q4 report for the period October to December 2022 and the full chart pack.

Learn how the ASX Rates Ecosystem services culminate in a highly regulated, diverse network that provides efficient access to deep liquidity required to manage risk. It’s a collection of debt, cash and interest rate solutions, that connects a global community.

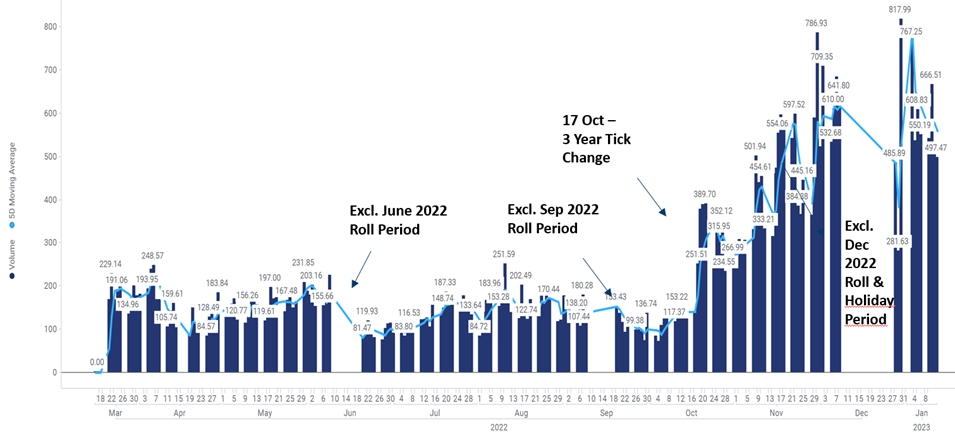

The increase in the 3 Year Bond Future minimum price increment (to 1bp from 0.5bps) went live successfully on 17 October 2022 as notified in the Market Notice published in early September.

The change has resulted in improvements in top of book and full orderbook liquidity in the 3 Year Bond futures contract, with this also supporting improved liquidity and activity in ASX 90-day bank bill futures contracts. The chart below shows the Average Top of Book Liquidity in ASX 3 Year Bond Futures from March 2022 to early January 2023:

While it remains too early to draw any firm conclusions from the change, the improvement in orderbook liquidity for both the 3 year bond futures and 90 day bank bill futures has begun to improve market efficiency; and market liquidity and activity is expected to continue to improve during 1H 2023.

During Q4 2022 the RBA continued with its rate tightening cycle to address rising inflation. 2022 has seen 8 consecutive rate increases driving the cash rate to 3.10% by December 2022, up from 0.10% in April. Market pricing as at 8 February 2023 indicates that the Target Cash Rate could reach 4% by August 2023.

Rates futures volumes for Q4 2022 were slightly lower down 5% vs Q3 2022 and down 6% vs PCP (Q4 2021). Open Interest finished the quarter at 2.6 million, down 11% compared to the same period last year and down 2% on Q2 2022.

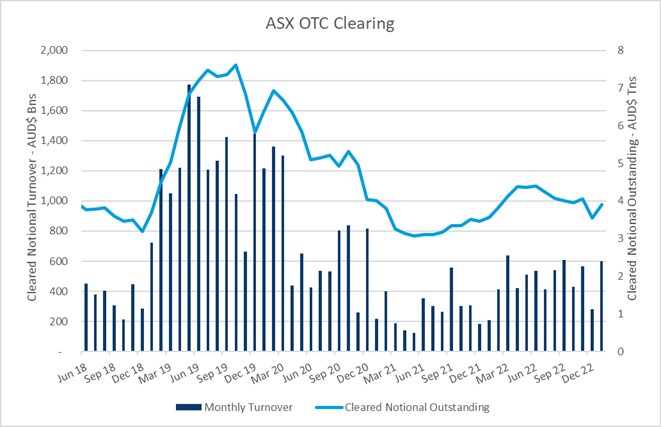

Global AUD OTC swap volumes continue to grow as a result of substantial growth in shorter-dated interest rate swap and OIS volumes. ASX’s OTC Clearing service has recorded total notional cleared of A$1.28 trillion in Q4 2022, up 62% vs pcp.

Continued growth in longer dated swaps: ASX has grown its activity and market share in longer dated interest rate swaps, with Weighted Average Maturity of ASX Cleared Interest Rate Swaps currently at 2.1 years. This continues to be above the long running average for the service, despite the recent growth in shorter dated swaps with market participants taking advantage of the available cross-margining offsets (average 45% cross-margining benefit across users of ASX’s Margin Optimisation service), which support a lower total cost of clearing.

In November 2022, ASX held its second OTC Multilateral Compression Cycle via TriOptima (part of OSTTRA) with a significant majority of ASX's OTC Participants taking part in the cycle.

$1.28 trillion

Total notional cleared in Q4 2022, up 62% vs pcp.

2.1 years

Weighted Average Maturity of ASX Cleared OTC swaps, remaining above the long running average despite recent growth in shorter-dated interest rate swaps and OIS activity.

45%

Average Cross-Margining benefit across users of ASX’s Margin Optimisation Service.

Automated Futures vs OTC Cross Margining.

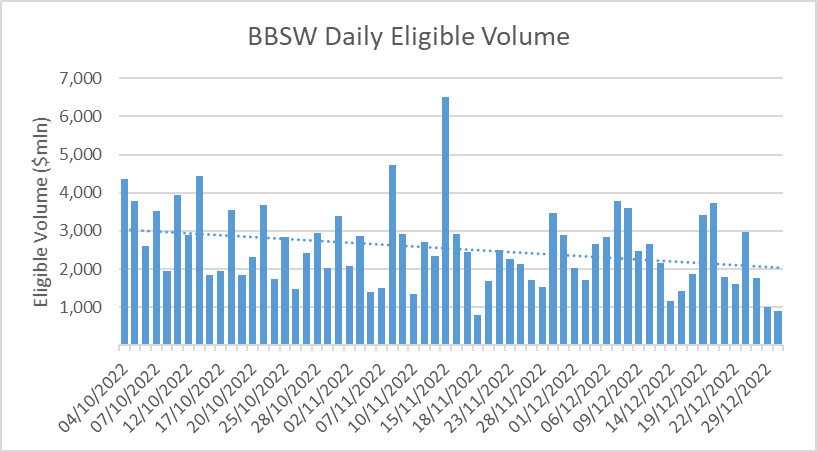

The key theme of Q4 has been the elevated average daily eligible volumes seen in Prime Bank NCDs. These stronger than usual volumes have been driven by an increasing investor base amidst a higher yield curve environment.

BBSW Daily eligible volume averaged $2.55 billion for the quarter ($2.27 in Q3 2022). 15 November also saw the largest eligible volume day in BBSW history with $6.5 billion worth of eligible transactions contributing to BBSW across all 6 tenors.

The elevated eligible daily volumes have translated into an increase in how often we form BBSW using the transaction-based layer. On average, 3.77 tenors out of 6 were formed using transactions over Q4 (3.43 in Q3 2022).

Prime Bank Issuance outstanding measured $124 billion at the end of December compared to $121 billion at the end of September 2022.

For any queries, please contact FISales@asx.com.au