We are pleased to provide the ASX Rates Highlights Q1 report for the period January to March 2023 and the full chart pack.

ASX Rates Highlights Q1 – January to March 2023

OTC, Futures and Benchmarks insights – Q1 2023

ASX Rates Highlights Q1 – January to March 2023

OTC, Futures and Benchmarks insights – Q1 2023

We are pleased to provide the ASX Rates Highlights Q1 report for the period January to March 2023 and the full chart pack.

The first quarter of 2023 was punctuated by substantial volatility at the end of the quarter following the collapse of Silicon Valley Bank and take-over of Credit Suisse. The short-end of the curve showed intra-day trading ranges of over 40bps in the immediate aftermath of the turmoil before reverting to more regular levels by the end of March. The fluctuation in futures price range during March drove an increase in trading activity throughout the period. The table below outlines the March trading range, volume and open interest for the benchmark interest rate products.

The continued focus on inflation saw further tightening in the US and Europe during March whilst the RBA opted to hold rates at 3.6% in their announcement on 4 April. The RBA noted the need to provide further time to analyse the impact of the increase in interest rates to date. As at 4 April, market pricing predicts a 9% chance of a 25bp rate rise at their next announcement on 2 May.

In New Zealand, a 25bp increase was widely anticipated on 5 April. The RBNZ opted to raise interest rates by 50bps taking the cash rate to 5.25%. NZ bank bill futures yields declined by approximately 25bps in response to the larger increase. The Reserve Bank cited ongoing concerns around the persistence of core and headline inflation.

Global AUD OTC Swap Volumes grew substantially in the quarter following aforementioned macroeconomic event-driven volatility. ASX's OTC Clearing service recorded total notional cleared of A$2.278 Trn in Q1, up 82% vs PCP.

Open Interest on the service is at A$4.43 Trn up 8% vs PCP, with continued activity and market share growth in longer dated interest rate swaps supported by Participant's taking advantage of the available cross-margining offsets (average 45% cross-margining benefit across all users) which supports a lower total cost of clearing.

ASX introduced new customer requested product functionality during 2022 to support customers clearing Asset Swaps and swaps with IMM AUD rolls. Activity in these products grew substantially in Q1 with over $50bn notional value leveraging the new functionality.

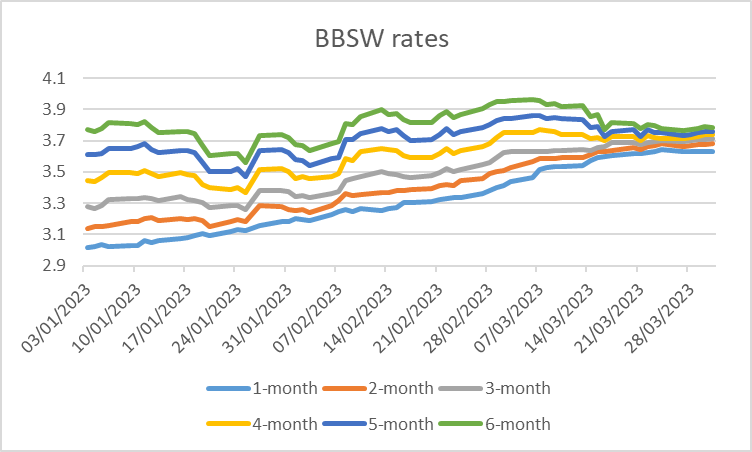

In Q1, yields on 3-6-month Prime Bank NCDs printed at their highest levels in 10 years. This was followed by an abrupt repricing lower amidst the recent banking turmoil. After the aggressive steepening, the 1-6-month spread is now at its narrowest point since December 2021. This has been driven by increasing yields in the shorter dated tenors as the markets priced in future rate increases.

BBSW eligible daily volumes averaged $2.24bln per day ($2.55bln for Q4 2022). On 21 March, we also saw the second largest eligible volume day in BBSW history with $6.01bln of eligible transactions contributing to transactions across all tenors.

On average, BBSW has been formed using the transaction-based layer 3.32 tenors out of 6 for the last quarter (3.77 tenors for Q4 2022). This slight reduction has been marked by an increase in activity in shorter dated tenors.

Prime Bank Issuance outstanding as at 31 March measured $129bln compared to $124bln in Q4 2022.

Email: FIsales@asx.com.au

www2.asx.com.au/bond-derivatives

Domestic: telephone 131 279

International: telephone +61 2 9338 0000