We are pleased to provide the ASX Rates Highlights Q3 report for the period July to September 2022 and the full chart pack.

ASX Rates Highlights Q3 – July to September 2022

OTC, Futures and Benchmarks insights – Q3 2022

ASX Rates Highlights Q3 – July to September 2022

OTC, Futures and Benchmarks insights – Q3 2022

We are pleased to provide the ASX Rates Highlights Q3 report for the period July to September 2022 and the full chart pack.

The RBA published a review of its bond purchase program that took place between November 2020 and February 2022.

During Q3 2022 the RBA continues with its rate tightening cycle to combat rising inflation. Following rate hikes in May, June and July, further increases were announced for August and September. On 4 October, the RBA raised the Target Cash Rate by a further 25bp taking the cash rate to 2.60%. Market pricing indicates that the Target Cash Rate will reach 3.5% by mid-2023.

Rates futures volumes were down 8% vs Q2 2022 and flat when compared to the same period last year (Q3 2021). Open Interest finished the quarter at 2.7mln, down 9.30% compared to the same period last year and down 2% on Q2 2022.

Despite flat overall volumes vs pcp higher activity was seen in the short-end futures with the 30-day cash rate futures up 677% and 90-day Bank Bill Futures were also up 71%, compared to Q3 2021.

Employment data was strong in July 2022 with the unemployment rate at 3.4%, the lowest since 1974.

On 16 August 2022, ASX published a Market Notice announcing an increase in the Minimum Price Increment (from 0.5 basis point to 1 basis point) on the 3 Year Bond Futures (outside of the roll period only) to improve market quality and liquidity in response to challenging market conditions.

In late August ASX hosted a customer forum to present the rationale for increasing the 3 Year Bond Futures minimum price increment and included detailed analysis on the changing dynamics of the order book, covering top of book and market depth data.

The reduction in Minimum Price Increment is a temporary change in response to market conditions, and will be reversed at a point in the future when conditions have improved enough to sustainably support a finer price increment.

The increase in the 3 Year Bond Future minimum price increment (to 1bp from 0.5bps) will go live on 17 October 2022 as notified in the Market Notice published in early September.

OTC Multilateral Compression Cycle: The next OTC Multilateral Compression cycle on ASX’s OTC Clearing service via TriOptima (part of OSTTRA) is being planned for November 2022.

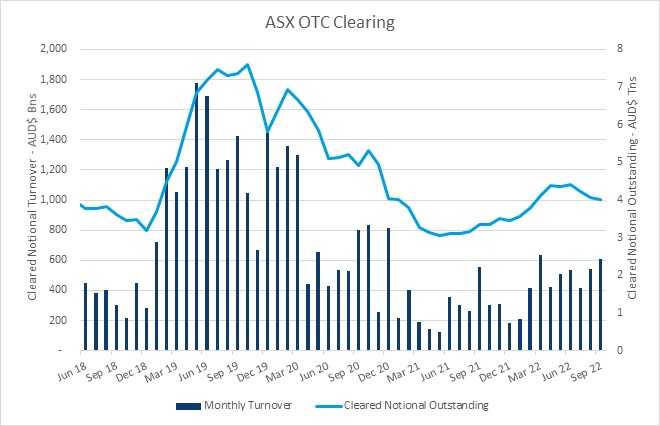

$1.56 Trillion

Total notional cleared in Q3 2022, up 40% vs pcp.

2.1 years

Weighted Average Maturity of ASX Cleared OTC swaps, remaining above the long running average despite recent growth in shorter-dated interest rate swaps and OIS activity.

45%

Average Cross-Margining benefit across users of ASX’s Margin Optimisation Service.

Automated Futures vs OTC Cross Margining.

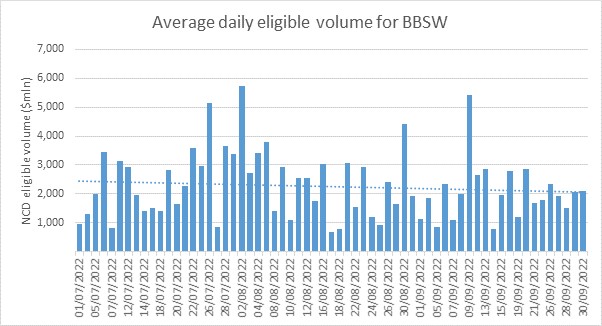

The key theme of Q3 2022 has been the continued increase in yields on Prime Bank NCDs as shorter dated interest rate products reprice on the back of inflationary pressures and resulting rate increases.

Amidst a higher yield environment, we have seen BBSW daily eligible volume average $2.36 billion for the quarter ($2.03 billion in Q2 2022). This has also resulted in the two largest eligible volume days in BBSW history occurring in the last quarter. 2 August 2022 saw the largest day with a volume of $5.72 billion, with the second largest day occurring on 9 September 2022 with a volume of $5.42 billion.

This has translated to on average 3.43 tenors forming per day over the quarter (3.15 tenors for Q2 2022). Prime Bank Issuance outstanding measured $121 billion in mid-September compared with $122 billion at the end of June 2022.