The last few years have seen unprecedented change in the corporate actions landscape - with markets, vendors and investors instigating major transformation across the lifecycle.

ASX is proud to sponsor an industry-wide benchmarking program on corporate actions processing in Australia, conducted by The Value Exchange. Insights from over 60 firms in the Australian corporate action community are detailed in a comprehensive report designed to help financial organisations chart the right course for change tomorrow.

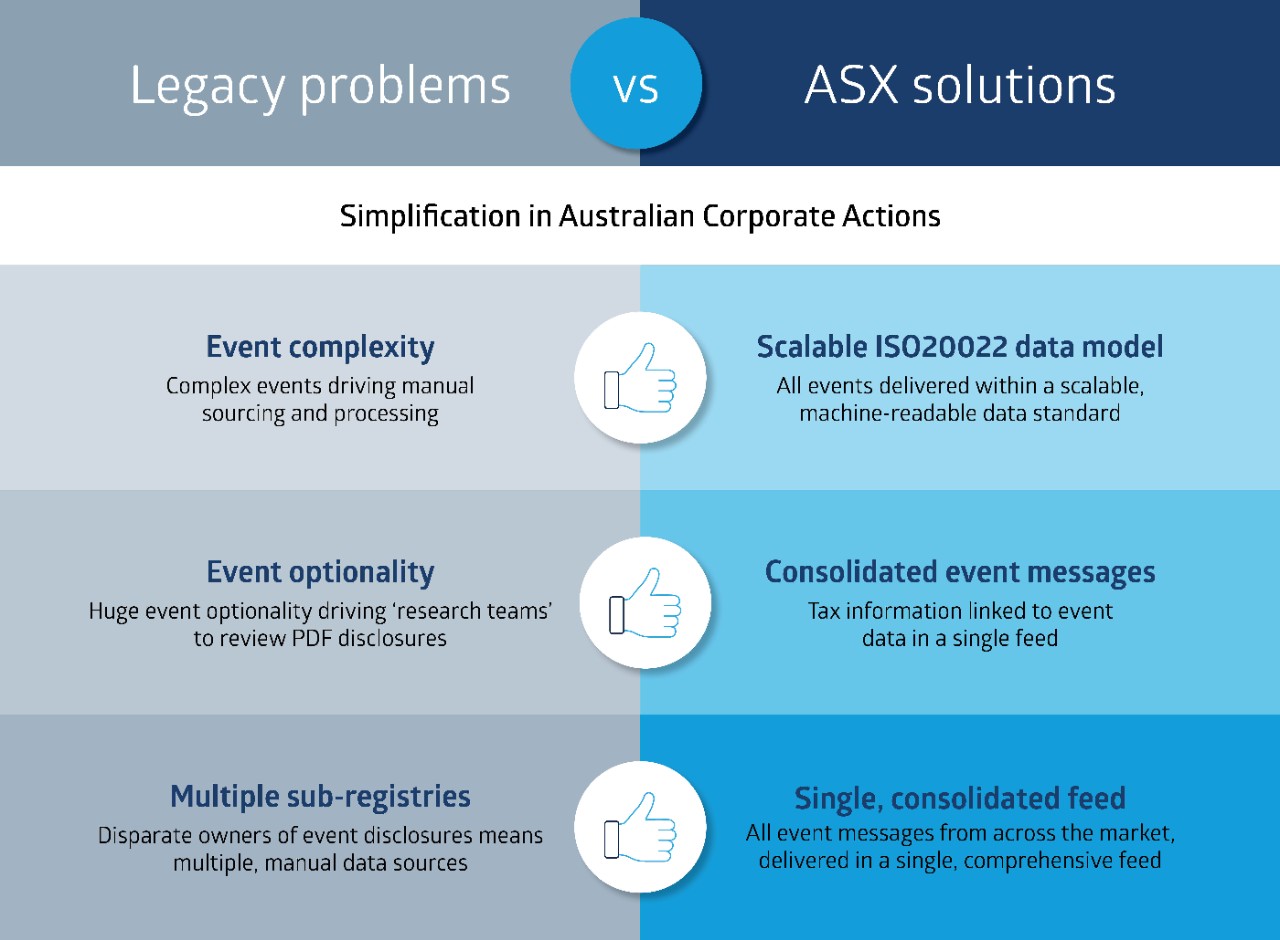

Research shows the average business unit faces annual costs of USD2 million due to corporate action errors and the majority of these costs are derived from data sourcing and management. This report discusses the challenges and opportunities for corporate actions processing in Australia and presents the case for change.